An Unbiased View of Transaction Advisory Services

The 10-Minute Rule for Transaction Advisory Services

Table of ContentsThe Main Principles Of Transaction Advisory Services See This Report about Transaction Advisory Services6 Simple Techniques For Transaction Advisory ServicesSee This Report on Transaction Advisory ServicesTransaction Advisory Services - Questions

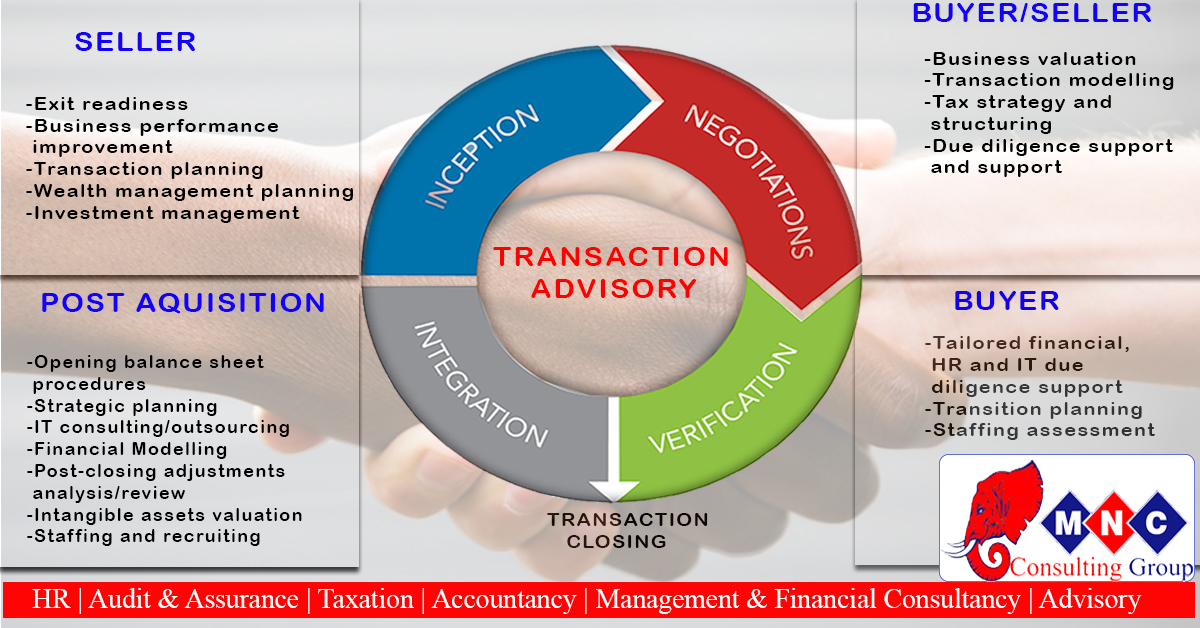

This step makes certain the organization looks its best to possible buyers. Obtaining the business's worth right is essential for an effective sale. Advisors use various methods, like affordable capital (DCF) evaluation, comparing to similar companies, and current deals, to find out the fair market value. This aids establish a reasonable price and bargain effectively with future purchasers.Deal experts action in to aid by getting all the needed information arranged, responding to questions from customers, and preparing sees to the organization's location. This constructs depend on with buyers and keeps the sale relocating along. Getting the most effective terms is key. Transaction experts utilize their expertise to aid local business owner manage hard settlements, satisfy purchaser expectations, and structure bargains that match the proprietor's goals.

Satisfying legal rules is essential in any organization sale. Deal advisory solutions work with lawful experts to produce and evaluate agreements, arrangements, and other lawful papers. This lowers risks and makes certain the sale adheres to the legislation. The role of transaction experts extends past the sale. They assist local business owner in preparing for their next steps, whether it's retired life, starting a new endeavor, or managing their newfound wide range.

Purchase advisors bring a riches of experience and understanding, guaranteeing that every element of the sale is handled expertly. With critical prep work, valuation, and settlement, TAS assists organization proprietors achieve the highest possible list price. By ensuring legal and governing conformity and managing due diligence alongside various other bargain staff member, purchase consultants lessen prospective risks and responsibilities.

Some Known Incorrect Statements About Transaction Advisory Services

By contrast, Large 4 TS teams: Deal with (e.g., when a potential purchaser is conducting due diligence, or when a bargain is shutting and the buyer needs to integrate the firm and re-value the seller's Balance Sheet). Are with costs that are not connected to the deal closing efficiently. Earn charges per involvement somewhere in the, which is much less than what investment financial institutions earn even on "little offers" (yet the collection likelihood is additionally much higher).

, however they'll concentrate extra on bookkeeping and assessment and less on topics like LBO modeling., and "accounting professional only" subjects like trial balances and exactly how to stroll through occasions using debits and credit scores instead than financial declaration adjustments.

The Definitive Guide to Transaction Advisory Services

Professionals in the TS/ FDD groups might likewise speak with management about every little thing over, and they'll compose a comprehensive report with their searchings for at the end of the procedure.

The power structure in Deal Solutions differs a bit from the ones in investment banking and personal equity careers, and the general form looks like this: The entry-level role, where you do a lot of information and economic evaluation (2 years for a promo from right here). The next level up; comparable job, however you obtain the more fascinating bits (3 years for a promotion).

Particularly, it's hard to get advertised past the Manager level since few people leave the work at that phase, and you require to start revealing proof of your capacity to produce income to breakthrough. Let's begin with the hours and way of living given that those are simpler to explain:. There are periodic explanation late nights and weekend job, yet nothing like the frenzied nature of financial investment financial.

There are cost-of-living changes, so anticipate reduced settlement if you remain in a less expensive location outside major financial centers. For all positions other than Partner, the base salary comprises the bulk of the total payment; the year-end bonus may be a max of 30% of your base income. Usually, the ideal means to raise your incomes is to change to a different company and discuss for a higher wage and incentive

Transaction Advisory Services - Questions

At this phase, you should just remain and make a run for a Partner-level duty. If you want to leave, maybe move to a client and execute their assessments and due diligence in-house.

The major trouble is that because: You normally need to join one more Huge 4 group, such as audit, and work there for a few years and afterwards move into TS, work there for a few years and then move into IB. click to find out more And there's still no warranty of winning this IB role because it depends upon your region, clients, and the employing market at the time.

Longer-term, there is likewise some danger of and since assessing a firm's historic economic details is not specifically brain surgery. Yes, human beings will certainly constantly need to be included, however with advanced innovation, lower headcounts could potentially support client engagements. That said, the Transaction Solutions group beats audit in regards to pay, work, and exit chances.

If you liked this write-up, you may be interested in reading.

What Does Transaction Advisory Services Do?

Establish innovative economic structures that assist in establishing the actual market value of a company. Give consultatory operate in relationship to business appraisal to assist in bargaining and prices frameworks. Clarify one of the most suitable form of the deal and the kind of consideration to employ (money, supply, make out, and others).

Create activity prepare for threat and this website direct exposure that have actually been recognized. Execute assimilation preparation to determine the procedure, system, and business adjustments that might be needed after the offer. Make numerical quotes of combination costs and benefits to assess the financial reasoning of combination. Set guidelines for incorporating departments, innovations, and service processes.

Recognize possible reductions by lowering DPO, DIO, and DSO. Examine the possible customer base, sector verticals, and sales cycle. Consider the possibilities for both cross-selling and up-selling (Transaction Advisory Services). The functional due persistance provides important understandings right into the performance of the firm to be acquired concerning danger analysis and value development. Identify short-term modifications to finances, banks, and systems.